The Working Families Tax Credit/Recovery Rebate (HB 1297/SB 5387) provides direct cash assistance to the households that need it most. The Recovery Rebate builds on the success of the federal Earned Income Tax Credit (EITC), and makes Washington state’s version of the EITC, the Working Families Tax Credit, more equitable by:

- ensuring families with the lowest incomes receive more support by providing an annual cash rebate of $500 to qualifying households, plus $150 each for up to three kids; and

- including people who file taxes with an Individual Tax Identification Number (ITIN), who are unjustly excluded from unemployment insurance and federal stimulus efforts. ITIN filers include undocumented immigrants, certain student visa holders, and survivors of intimate partner violence, among others.

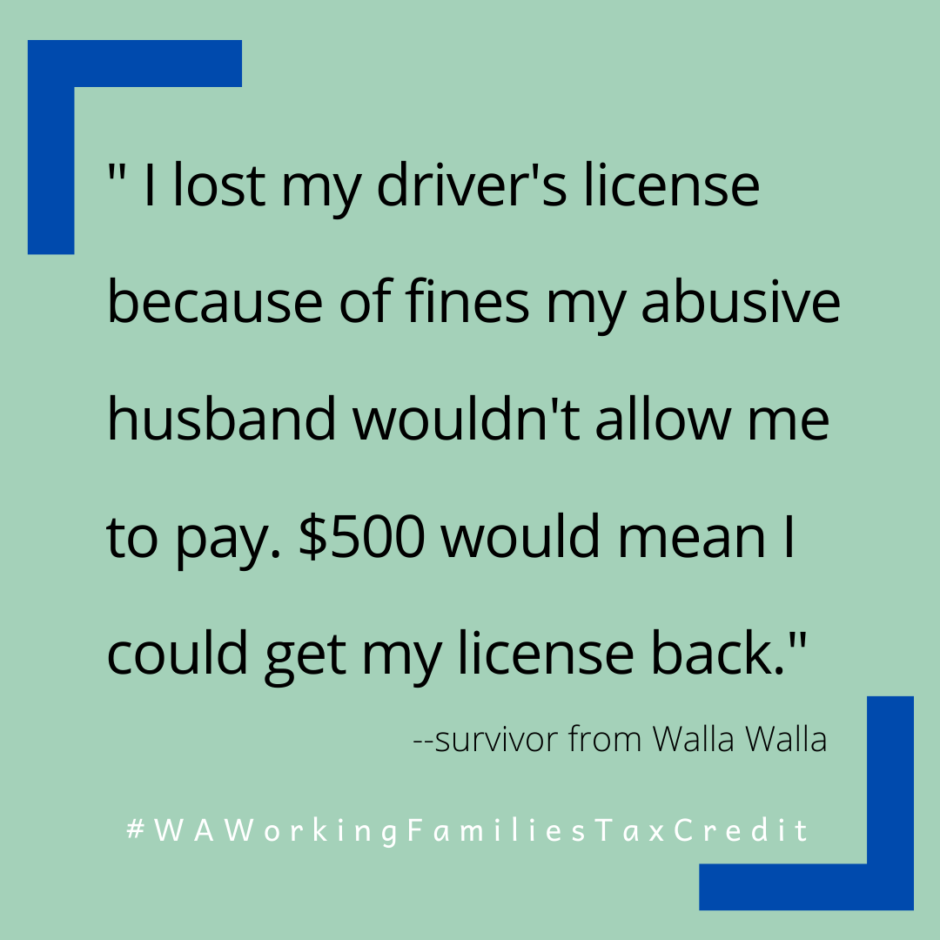

One of the main reasons people stay with an abusive partner is that they don’t have the money to support themselves or their children. Access to an additional $340 has been shown to help survivors in our state find safety and stability by covering things like car repairs needed to keep a job, or changing the locks so they can safely stay in their own home.

WSCADV’s Traci Underwood testified in support of HB 1297 on February 2, and Kalimah Ujaama testified in support of SB 5387 on February 4, to share what we’ve heard from survivors regarding the impact a Recovery Rebate of $500-$950 would have on their safety and ability to be independent of an abusive partner.

This bill is one of our legislative priorities this session because of the profound impact it would have on survivors’ options for safety and stability.