One of the biggest risk factors for experiencing domestic violence is having limited financial resources, which can entrap people in abusive relationships and make it harder to find safety and support. Access to cash gives survivors of domestic violence more choices, creating more opportunities for safety and stability.

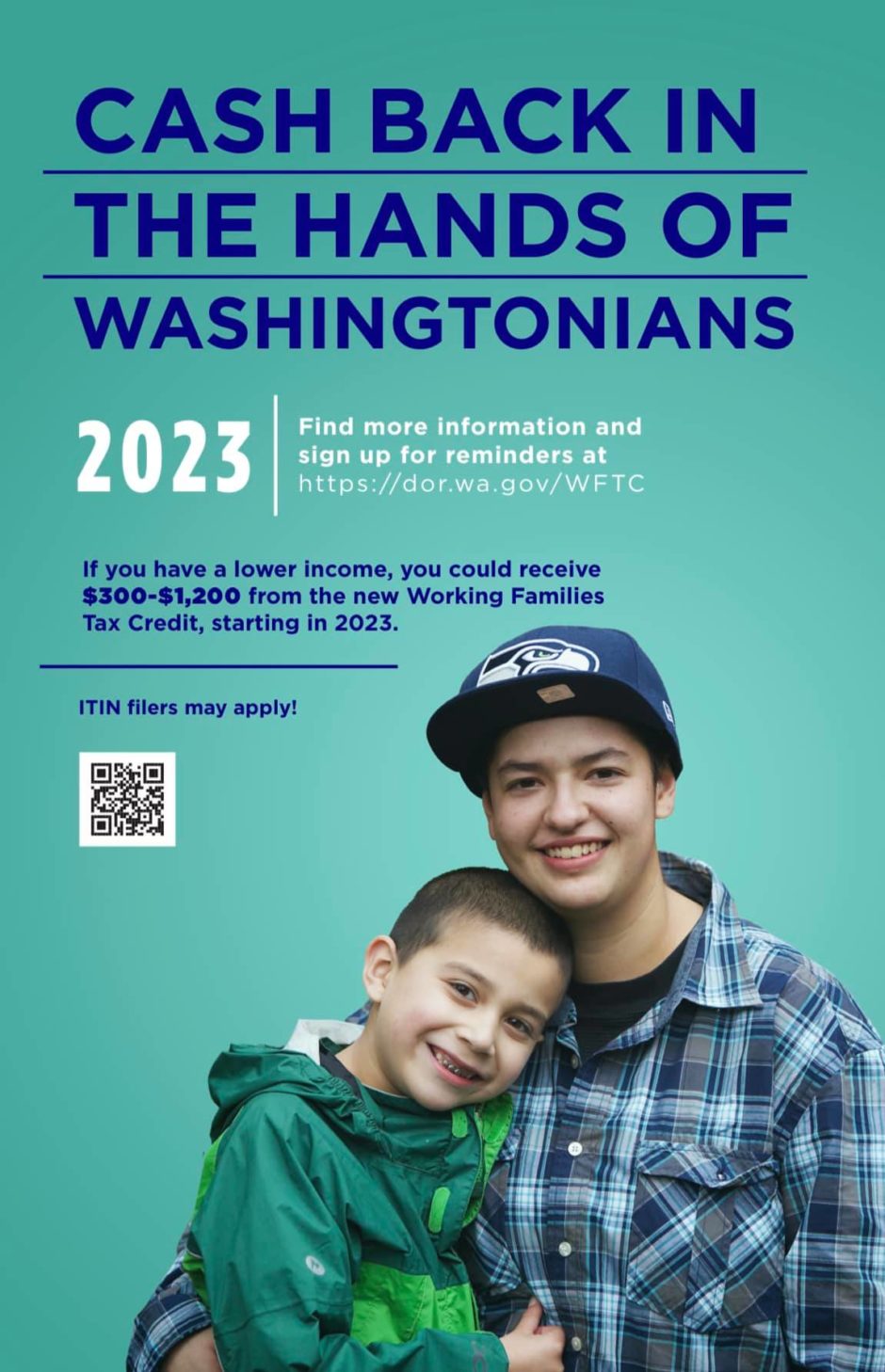

The Working Families Tax Credit was passed in 2021 after a decade of advocacy across the state. Starting in 2023, people with and without children, and people without a social security number, will be able to access up to $1200 a year – indefinitely! If at least one person in the household has worked at all in the current tax year, they will be eligible for this tax credit.

Flexible cash gives survivors of domestic violence the freedom they need to care for themselves and their families. When survivors can stay in their homes, get a driver’s license, take a class, pay back debt or pay for sports or extra-curricular activities, without having to depend on an abusive partner for money, everyone does better.

Check out the new Working Families Tax Credit website at www.WATaxCredit.org to sign up for updates, learn more about the credit, and check out resources and workshops. The website will serve as an information hub for WFTC outreach in the coming months. If you work with survivors and families who could benefit from the WFTC, make sure to sign up to be notified when applications open and to access upcoming train-the-trainer workshops!