![]() Ahhhh, retirement. Visions of schedule-free days, travel with loved ones, working through your bucket list that you’ve carefully crafted over the years.

Ahhhh, retirement. Visions of schedule-free days, travel with loved ones, working through your bucket list that you’ve carefully crafted over the years.

Wouldn’t that be nice? Unfortunately, it’s a word that can strike fear into the hearts of many working in this field.

RETIREMENT.

See?

And for good reason. Many of us are terrified that we won’t have enough to retire when we want to, or even enough to live comfortably when we can’t work anymore. So what about those days of carefree gardening and travel? How can we help make that (or whatever’s on your list) a reality for the folks who work at our programs? I don’t have all the answers, but I do have some information that can help us think about it.

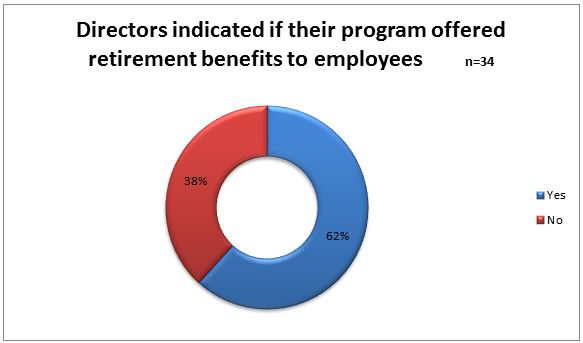

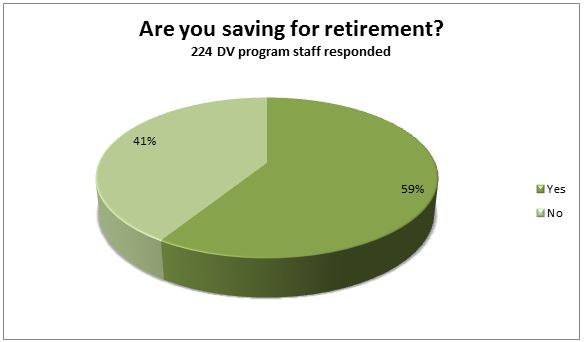

In the 2011 Wages and Benefits survey we asked employees of DV programs “Are you saving for retirement?” Here’s what folks who took the survey had to say to that.

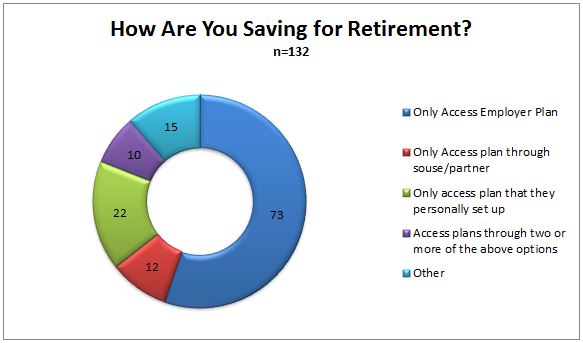

Among those who said they are saving for retirement, 64% said that they utilize the plan offered by their employer. Here’s a breakdown in a little more detail:

So some are saving (a little over half) and some are not. There are a lot of reasons why people don’t save—like they don’t have enough left over at after making ends meet, they don’t think they need to (I’m so young and carefree!), they don’t know how or even where to start. As an employer, you cannot necessarily address all the reasons why people aren’t saving, but what can you do? Figuring out how to offer a retirement plan is a great start, but even then, some employees won’t take advantage of it. What then? What have you done about this at your agency, if you offer retirement plans? (Here’s a suggestion that you might have seen before, hint, hint).

There’s not easy answer to these questions, nor The Big One—How on earth am I supposed to manage and make a retirement plan option worthwhile for my employees? Where’s that time and money going to come from? Good question. Who’s doing it? How’s that going? We’d love to hear from you!